Asset tokenization is rapidly emerging as a game-changing innovation in the world of finance and investment. By using blockchain technology to create digital tokens that represent ownership of real-world assets, asset tokenization enables greater liquidity, efficiency, and accessibility in the trading of assets. With the rise of Web3, the latest evolution of the internet that promises a more decentralized, open, and interconnected digital ecosystem, the potential for asset tokenization to transform finance and investment is greater than ever before.

In this article, we will explore the basics of asset tokenization in Web3, including how it works, the benefits it offers, and the challenges and risks that come with it. We will also examine use cases and examples of successful asset tokenization projects, and discuss the future of asset tokenization in Web3 and its implications for investors, businesses, and the broader financial system.

Table of Contents

The Basics of Asset Tokenization on the Blockchain

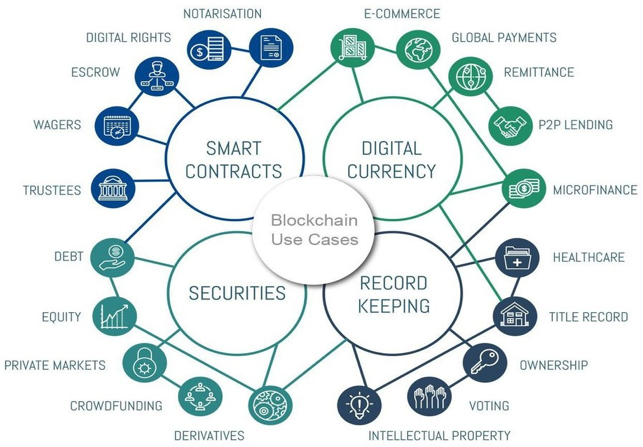

Asset tokenization is the process of converting ownership of an asset, such as real estate, stocks, or artwork, into digital tokens that can be traded on a blockchain. The blockchain is a decentralized and immutable digital ledger that records transactions transparently and securely.

To tokenize an asset, the first step is to create a digital representation of the asset, usually in the form of a smart contract. A smart contract is a self-executing contract that contains the terms and conditions of the transaction between the buyer and the seller. The smart contract is then stored on the blockchain, where it can be accessed and executed by anyone with the right permissions.

Once the smart contract is created, the next step is to issue digital tokens that represent ownership of the asset. These tokens can be customized to represent

different types of assets, such as equity shares, debt securities, or even fractional ownership of a property. The tokens are then distributed to the investors who participate in the asset tokenization project.

Benefits of Tokenizing Assets

Asset tokenization, including the use of Non – Fungible Tokens (NFTs), offers several benefits that make it an attractive option for investors, businesses, and even governments. Here are some of the key benefits of tokenizing assets, including NFTs, in Web3:

- Greater liquidity

By tokenizing assets, investors can trade them on blockchain-based exchanges 24/7, without the need for intermediaries such as brokers or banks. This can lead to greater liquidity, as tokens can be easily bought and sold by a wider range of investors. The use of NFTs, which represent unique and indivisible assets, can further increase liquidity by enabling the trading of one-of-a-kind items such as artwork, collectibles, or virtual real estate.

- Fractional ownership

Tokenization enables fractional ownership of assets, meaning that investors can buy and sell smaller portions of assets, such as a fraction of a property or a painting. This can make it easier for investors to diversify their portfolios and invest in a wider range of assets, including unique items that were previously difficult to trade.

- Transparency

The blockchain provides a transparent and immutable record of all transactions, which can increase transparency and accountability in asset trading. This can also help to reduce the risk of fraud and increase trust between buyers and sellers. The use of NFTs can further enhance transparency by enabling the authentication and provenance of unique assets.

- Accessibility

Asset tokenization can make it easier for investors to access assets that were previously out of reach, such as high-value real estate, rare artwork, or exclusive digital content. By enabling fractional ownership and lowering the entry barrier, tokenization can democratize access to investment opportunities. NFTs can also enable access to exclusive digital content, such as virtual real estate, in the metaverse.

- Efficiency

Asset tokenization can reduce the time and cost associated with traditional asset trading, such as the need for intermediaries, paperwork, and legal fees. By using smart contracts and blockchain technology, asset tokenization can streamline the process of buying and selling assets. The use of NFTs can further increase efficiency by enabling the automated execution of contracts and the transfer of unique assets.

Challenges and Risks of Asset Tokenization

While asset tokenization offers several benefits, there are also challenges and risks associated with this emerging technology. Here are some of the key challenges and risks of asset tokenization in Web3:

- Regulation

As asset tokenization is a relatively new technology, there is still a lack of regulatory clarity and consistency around the world. This can create uncertainty and legal risks for investors and businesses who want to tokenize assets. Governments and regulatory bodies are currently working on developing frameworks and guidelines to regulate asset tokenization, but it may take time for these regulations to become standardized and widely adopted.

- Security

As with any technology that involves the transfer of assets or sensitive information, security is a major concern in asset tokenization. Hackers and cybercriminals may try to exploit vulnerabilities in the blockchain or smart contracts to steal assets or manipulate transactions. To mitigate these risks, tokenization platforms need to implement strong security measures and conduct regular audits and vulnerability testing.

- Liquidity

While tokenization can increase liquidity for certain assets, such as high-value real estate, it may not be suitable for all assets. Some assets may have low demand or be illiquid, meaning that it may be difficult to find buyers or sellers for the tokens. In addition, the value of tokens may be affected by market conditions and investor sentiment, which can lead to volatility and liquidity issues.

- Adoption

For asset tokenization to be successful, it needs to be widely adopted by investors, businesses, and other stakeholders. However, adoption may be slow if there is a lack of awareness, trust, or understanding of the technology. Education and outreach efforts will be important to build awareness and trust in asset tokenization.

- Interoperability

With the proliferation of different tokenization platforms and protocols, interoperability may become a challenge. Tokenized assets may be incompatible with certain platforms or may require complex bridging solutions to enable cross-chain trading. To address this challenge, industry standards and protocols for interoperability will need to be developed.

As the technology matures and regulatory frameworks evolve, these challenges will likely be mitigated, and asset tokenization will become a more viable and widely adopted option for investors and businesses.

Real-World Use Cases of Asset Tokenization

Asset tokenization has the potential to revolutionize the way we own, invest in, and transfer assets. Here are some real-world use cases of asset tokenization in Web3:

- Real Estate

One of the most promising areas for asset tokenization is real estate. By tokenizing real estate assets, investors can buy and sell fractional ownership in a property, making it easier and more affordable for individuals to invest in high-value properties. Tokenization can also increase liquidity for real estate assets, as it allows investors to easily buy and sell tokens on secondary markets.

- Art

The art market is another area where tokenization is gaining traction. By tokenizing artwork, collectors, and investors can buy and sell fractional ownership in a piece of art, making it more accessible to a wider range of investors. Tokenization can also provide transparency and authentication for the artwork, reducing the risk of fraud or forgery.

- Commodities

Tokenization can also be applied to commodities such as gold, oil, and other natural resources. By tokenizing commodities, investors can buy and sell fractional ownership in these assets, providing greater access and liquidity to commodity markets.

- Intellectual Property

Tokenization can also be used for intellectual property such as patents, copyrights, and trademarks. By tokenizing these assets, creators, and inventors can sell or license fractional ownership of their intellectual property, allowing them to monetize their ideas and creations more effectively.

- Venture Capital

Finally, tokenization can also be used for venture capital funding. By tokenizing shares in a startup or early-stage company, investors can buy and sell fractional ownership in the company, providing greater liquidity and access to early-stage investment opportunities.

- Supply Chain

Asset tokenization is also gaining traction in supply chain management. By tokenizing products and goods, supply chain participants can track their movement and ownership more efficiently and transparently. Tokenization can also be used to verify the authenticity and provenance of products, enabling consumers to have greater confidence in the quality of what they purchase. Additionally, tokenization can facilitate more efficient financing and payment processes within supply chains, reducing the need for intermediaries and improving cash flow.

These are just a few examples of the many real-world use cases for asset tokenization in Web3, we can expect to see even more innovative applications of asset tokenization in the future.

The Future of Asset Tokenization

While there are still challenges to overcome, the future of asset tokenization in Web3 is full of opportunities and implications.

As asset tokenization continues to evolve and mature, it will have significant implications for various industries and stakeholders. For investors, asset tokenization can provide access to new markets and investment opportunities. For companies, it can enable new business models and improve supply chain efficiency. For regulators, it will require the development of new regulatory frameworks that balance innovation and investor protection.

In conclusion, asset tokenization is a promising technology that has the potential to transform the way we invest, own, and manage assets. The opportunities and implications of asset tokenization in Web3 are vast, and we can expect to see significant innovation and growth in this area in the coming years.

An experienced leader in software engineering and technology, I’ve driven value for top-tier Fortune 100 and 500 clients as the former CTO of Big Drop Inc. Overseeing a global team, we secured 34 global awards for pioneering web design using our proprietary tech. As the Co-Founder of Motion Design School, I created an innovative platform for global artists. Now, I apply my expertise to the dynamic world of blockchain, leveraging years of experience to shape decentralized technology’s future.