Decentralized applications, or DApps, have revolutionized the way we interact with technology. These blockchain-powered applications offer a range of benefits, including increased security, transparency, and immutability. From gaming to healthcare, DApps have been developed in various industries, and their potential impact is enormous. In this post, we will explore 10 creative examples of DApps across different industries and discuss their benefits, limitations, and potential impact. Whether you’re a blockchain enthusiast or simply curious about how DApps are changing the game, this post will provide valuable insights into the innovative applications of this technology. So, buckle up and get ready to discover how DApps are transforming industries from the ground up.

Table of Contents

10 Creative Dapp Examples

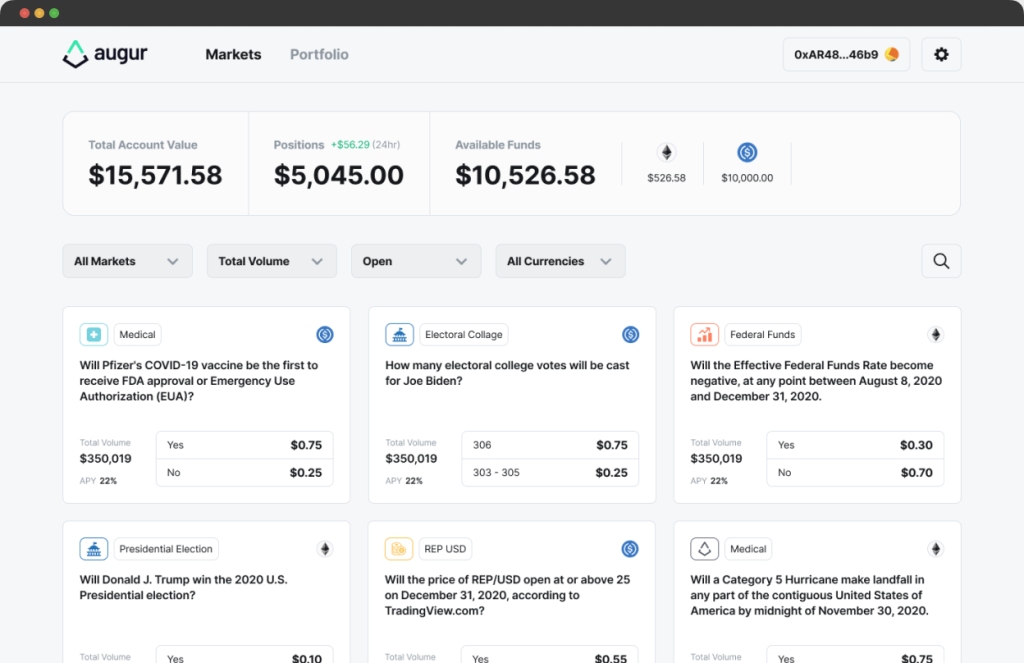

Augur – Betting Platform

This is a decentralized prediction market platform that allows users to create and trade on prediction markets for anything from political elections to sporting events. The platform uses Ethereum smart contracts to ensure transparency and security, and users are incentivized to make accurate predictions through a token-based reward system. With Augur, users can tap into the collective knowledge of a global community to make informed decisions and potentially profit from accurate predictions.

Pros:

- Decentralization: Being a decentralized platform, Augur offers the benefit of transparency and immutability. The platform is resistant to censorship and any attempt to manipulate data, ensuring the accuracy of predictions and avoiding any conflict of interest.

- Global Accessibility: Augur is accessible to anyone with an internet connection, without any geographical restrictions. This allows for a large and diverse group of participants, which can lead to more accurate predictions.

- Lower Fees: Traditional prediction markets are usually centralized, which means they charge a higher fee for their services. However, Augur’s decentralized nature allows it to charge lower fees for its services.

- Variety of Markets: Augur allows users to create markets on a wide range of topics, from politics to sports and entertainment, providing a more diverse set of options for users to participate in.

Cons:

- Complexity: While the decentralized nature of Augur is a pro, it also adds a layer of complexity to the platform. Users may require a certain level of technical expertise to navigate the platform effectively.

- Slower Transactions: As Augur runs on the Ethereum blockchain, transaction times can be slower, especially during periods of high network congestion. This can result in delays in creating and resolving markets.

- Limited User Base: As a relatively new and niche platform, Augur has a smaller user base compared to more established prediction markets. This can limit the number of participants in each market and potentially affect the accuracy of predictions.

- Regulatory Issues: The regulatory environment surrounding prediction markets is still unclear in many jurisdictions. This can make it difficult for Augur to expand its user base and market offerings in certain regions.

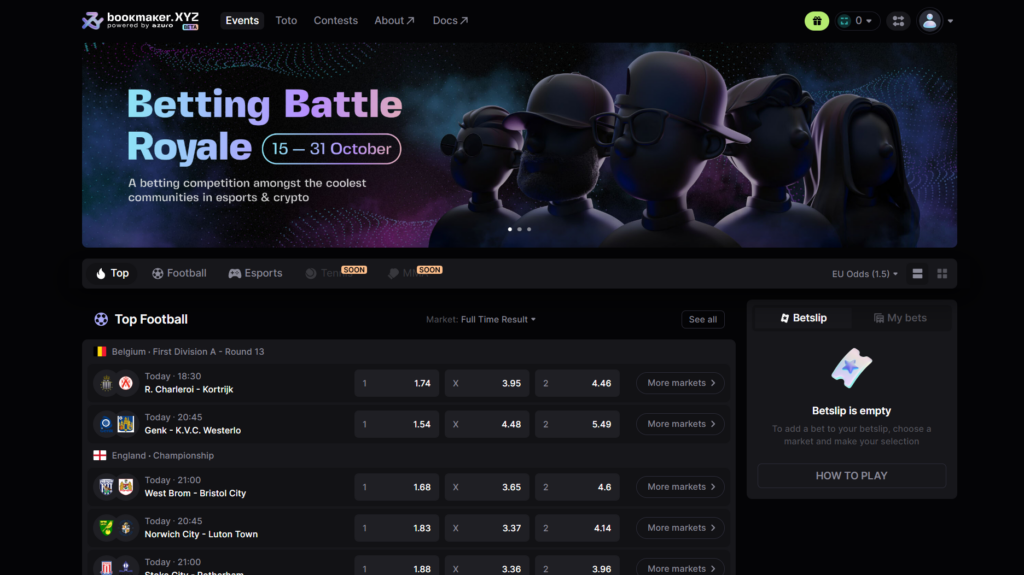

Gnosis (Azuro) – Prediction Market Platform

Gnosis is another decentralized prediction market platform that allows users to create and trade on prediction markets for a variety of events. The platform uses smart contracts to ensure transparency and security, and it allows for a wide range of market types. Gnosis also includes a conditional token framework, which allows for more complex market conditions and outcomes.

Pros:

- Decentralization: Like Augur, Gnosis offers the benefits of decentralization, including transparency and resistance to censorship.

- Flexible Market Types: Gnosis allows for a variety of market types, from simple binary outcomes to more complex conditional markets.

- Advanced Features: The conditional token framework allows for more advanced market conditions and outcomes, giving users more flexibility in their predictions.

Cons:

- Complexity: Like Augur, Gnosis can be complex to navigate for users who are not familiar with decentralized platforms and smart contracts.

- Limited User Base: As a newer platform, Gnosis has a smaller user base compared to more established prediction markets.

- Slow Transactions: As with other Ethereum-based platforms, transaction times can be slow during periods of high network congestion.

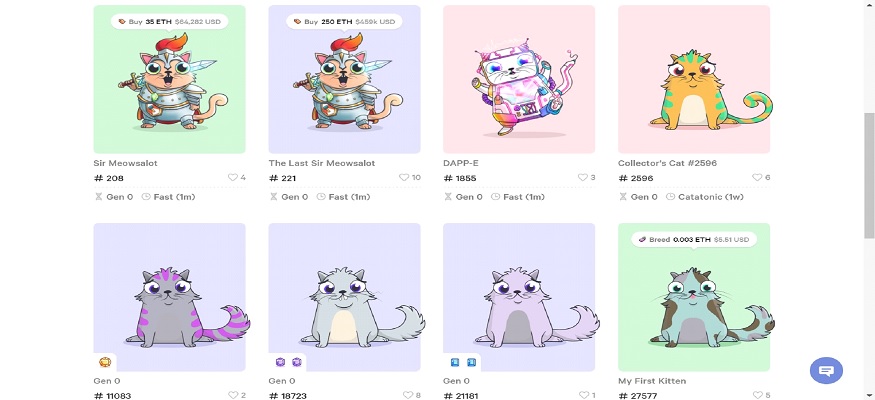

CryptoKitties – Collectible Game Dapp

CryptoKitties is a blockchain-based game that allows users to collect and breed digital cats, each with unique attributes and appearances. The game uses non-fungible tokens (NFTs) to represent each cat, and players can buy, sell, and breed their cats to create new ones.

Pros:

- Unique Concept: CryptoKitties was one of the first blockchain-based games to gain mainstream attention, and its unique concept of collecting and breeding digital cats has attracted a large following.

- High Collectibility: Each CryptoKitty is unique and represented by an NFT, which can give them high value in the secondary market.

- New Revenue Stream: For blockchain developers and artists, NFT-based games like CryptoKitties offer a new revenue stream through the creation and sale of unique digital assets.

Cons:

- Limited Gameplay: While collecting and breeding CryptoKitties can be enjoyable for some players, the gameplay can be limited and repetitive.

- High Transaction Fees: Each transaction on the Ethereum blockchain incurs a fee, and the popularity of CryptoKitties in late 2017 caused congestion and high transaction fees.

- Bubble Risk: As with any collectible or speculative asset, there is a risk of a bubble forming and prices crashing.

MakerDAO – Decentralized Stablecoin Platform

MakerDAO is a decentralized platform that allows users to create and trade a stablecoin called Dai. Dai is pegged to the US dollar and is backed by collateral in the form of Ethereum-based assets. Users can borrow Dai by collateralizing their own assets, and they can repay their debt and reclaim their collateral at any time.

Pros:

- Stability: Dai’s peg to the US dollar makes it a stable and reliable cryptocurrency, which can be useful for users who want to avoid the volatility of other cryptocurrencies.

- Decentralization: MakerDAO’s decentralized structure ensures transparency and security, and it avoids the potential for a central authority to manipulate the system.

- Collateralized Debt Positions: MakerDAO’s system of collateralized debt positions allows users to access liquidity without having to sell their assets, which can be useful for long-term investors.

Cons:

- Complex Collateralization: Users must collateralize their assets at a higher value than the amount of Dai they borrow, which can be complex to calculate and monitor.

- Volatility Risk: While Dai is stable in relation to the US dollar, it is still subject to the volatility of the Ethereum-based collateral assets.

- Regulatory Risk

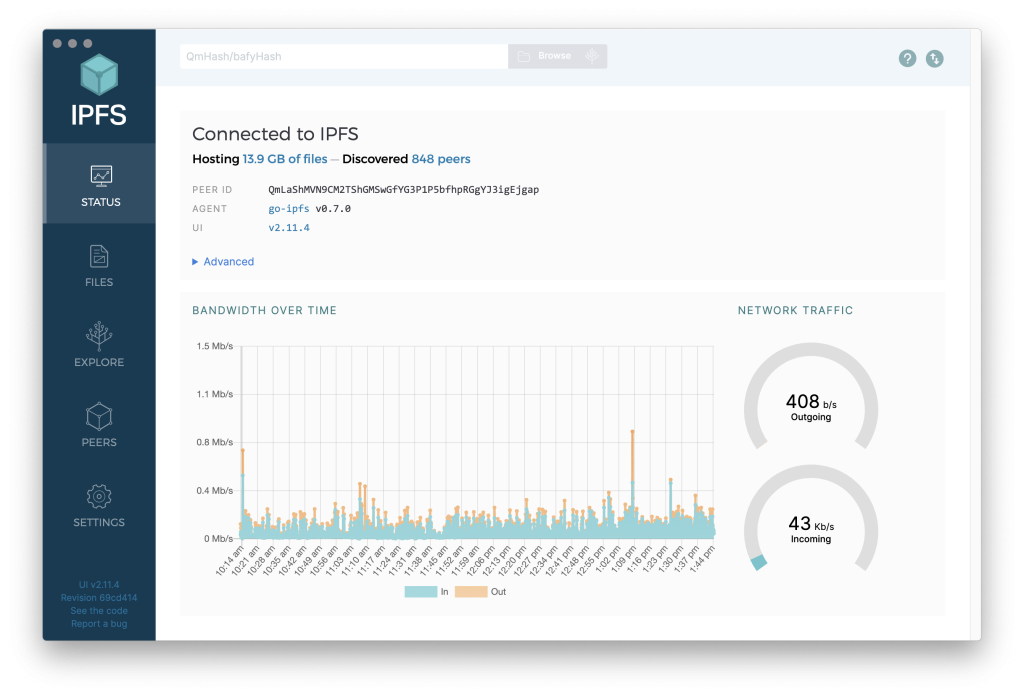

IPFS – Simple Dapp Example

Difficulty: 2

InterPlanetary File System (IPFS) is a decentralized file storage system that uses peer-to-peer networking to store and distribute files.

Pros:

- IPFS offers a decentralized alternative to centralized file storage systems, which can be vulnerable to data breaches and censorship.

- The platform is built on open-source technology and has a large and active developer community.

- IPFS allows users to access files quickly and securely from anywhere in the world.

- The platform has a user-friendly interface and is easy to use for both developers and non-technical users.

Cons:

- IPFS is still in the early stages of development, and its long-term sustainability is uncertain.

- The platform may face scalability issues as its user base grows.

- IPFS relies on a complex network of nodes, which can make it vulnerable to attacks.

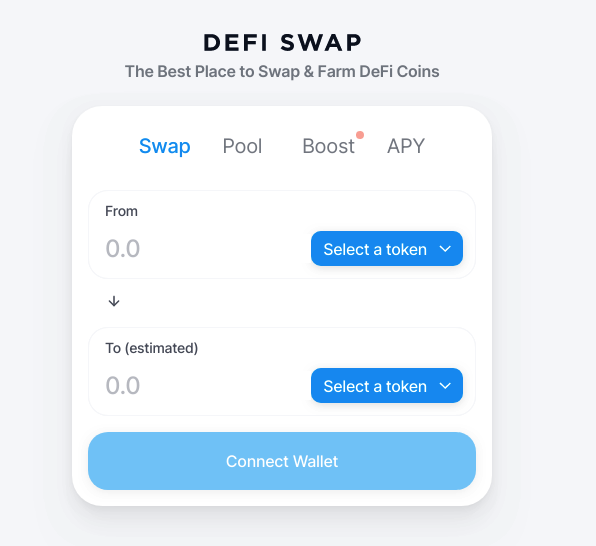

Crypto.com DeFi Swap Dapp

Difficulty: 3

Crypto.com DeFi Swap is a decentralized exchange platform that allows users to swap tokens in a decentralized manner. It’s built on top of the Ethereum blockchain and is powered by smart contracts. With DeFi Swap, users can earn rewards for providing liquidity to the platform, and the rewards are paid out in the form of the platform’s native token, CRV. The platform also offers staking options to its users, allowing them to earn additional rewards for holding and staking CRV tokens.

Pros:

- Decentralized: Being a decentralized exchange, DeFi Swap offers the benefits of a trustless system, with no intermediaries involved. Users can trade tokens without worrying about any middlemen or centralized control over their assets.

- Liquidity Provision: DeFi Swap incentivizes liquidity providers with rewards in the form of CRV tokens. This encourages users to provide liquidity to the platform, which in turn ensures that the platform always has sufficient liquidity to support trading activities.

- Lower Fees: Decentralized exchanges like DeFi Swap usually charge lower fees than centralized exchanges. This is because there are no intermediaries involved, which helps to reduce costs.

- Accessibility: DeFi Swap is accessible to anyone with an internet connection and an Ethereum wallet. There are no geographical restrictions, making it a truly global platform.

Cons:

- Limited Token Support: DeFi Swap currently supports only a limited number of tokens, compared to some of the larger centralized exchanges. This can limit the options available to traders and liquidity providers.

- Complexity: As with most decentralized exchanges, DeFi Swap can be complex for new users to navigate. The process of swapping tokens requires some technical knowledge, and users may need to familiarize themselves with the Ethereum blockchain and smart contracts to use the platform effectively.

- Lack of Regulation: The regulatory environment surrounding decentralized exchanges is still unclear in many jurisdictions. This can make it difficult for DeFi Swap to expand its user base and market offerings in certain regions.

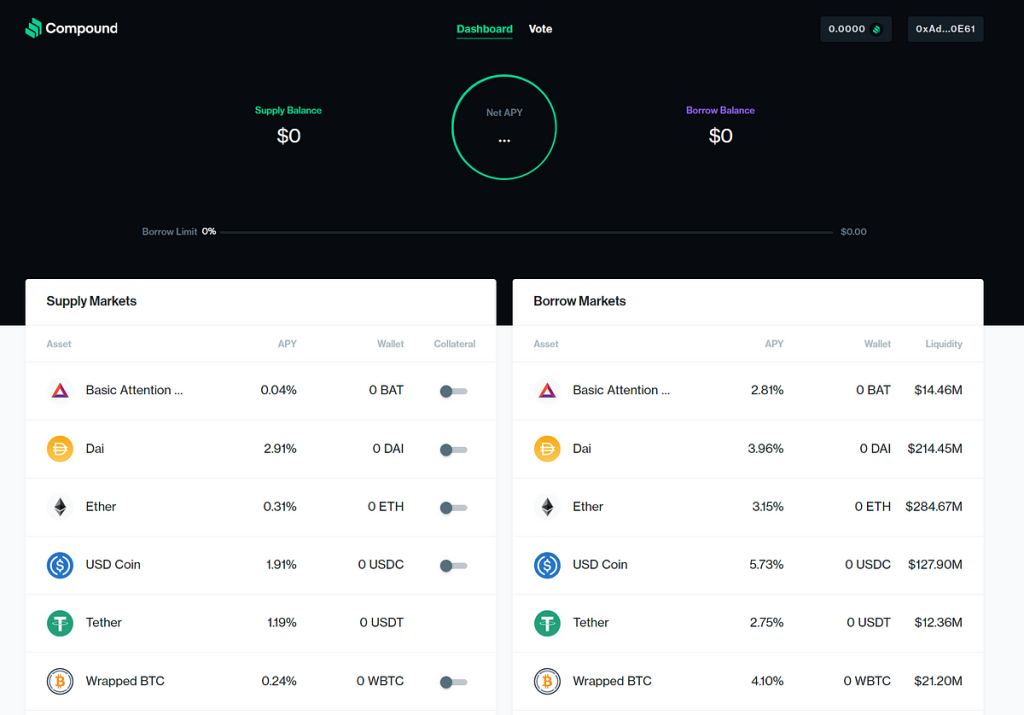

Compound – Lending Dapp

Difficulty: 4

Compound is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies. The platform uses smart contracts to automate lending and borrowing, and users earn interest on their deposits. Compound has quickly become one of the most popular DeFi platforms, with over $10 billion in assets locked in its protocol.

Pros:

- Decentralized: Like many DeFi platforms, Compound is decentralized, providing users with transparency, security, and immutability.

- Yield Farming: Compound’s lending and borrowing features enable yield farming, where users can earn rewards by providing liquidity to the platform.

- Governance: Compound has a decentralized governance model, where token holders can propose and vote on changes to the platform.

Cons:

- Complexity: As a DeFi platform, Compound can be complex for beginners to use, with multiple steps involved in the lending and borrowing process.

- Volatility: Cryptocurrency prices are highly volatile, which means that lending and borrowing on Compound carries some risk.

- Smart Contract Risk: While smart contracts are designed to be secure, there is always a risk of bugs or vulnerabilities that could result in loss of funds.

Numerai

Difficulty: 5

Numerai is a blockchain-based platform that uses machine learning to generate trading algorithms for the stock market. It allows anyone to contribute their own trading models to the platform and be rewarded with cryptocurrency. Numerai’s platform is decentralized, meaning that it’s open to anyone with an internet connection. This makes it a great option for people who are interested in stock trading, but don’t want to pay high fees to traditional brokers.

Pros:

- Decentralization: Numerai’s platform is decentralized, which means that it’s more secure and resistant to hacking. This is important when dealing with financial data and trading algorithms.

- Crowdsourcing: Numerai allows anyone to contribute their own trading models to the platform, which can lead to more accurate predictions and better returns for users.

- Transparency: Numerai is completely transparent about its performance and earnings, which builds trust and credibility with its user base.

Cons:

- Complexity: Numerai’s platform can be complex to navigate for people who aren’t familiar with trading algorithms and machine learning.

- Risk: Like any investment platform, there is always risk involved with using Numerai. Users should be aware of this and do their own research before investing.

Axie Infinity – Gaming and Marketplace

Difficulty: 4

Axie Infinity is a game that combines elements of Pokemon and Tamagotchi, built on the Ethereum blockchain. Players collect and breed fantasy creatures called Axies, which can battle other players’ Axies to earn rewards. Players can also earn cryptocurrency by selling their Axies or participating in the game’s governance.

Pros:

- Axie Infinity offers a fun and engaging gaming experience. The platform allows players to earn cryptocurrency and potentially make a living through gameplay.

- The use of blockchain technology ensures the security and authenticity of each Axie and transaction.

- Axie Infinity is built on a decentralized infrastructure, which ensures transparency and immutability.

Cons:

- Axie Infinity requires an initial investment to purchase Axies, which can be a barrier for some users.

- The gameplay can be time-consuming, which may not appeal to all users.

- The popularity of the game can result in network congestion, causing slow transaction times and high fees.

- The game’s success is dependent on the number of users and the market’s interest in blockchain gaming.

CryptoZombies – Dapp Tutorial for developers

Difficulty: 2

A dapp tutorial that teaches developers how to create a collectible game using Solidity and Ethereum. It starts with the basics and gradually introduces more advanced concepts.

Pros:

- Provides a step-by-step guide for beginners.

- Teaches Solidity, a widely used smart contract language.

- Provides a fun and engaging way to learn about dapp development.

Cons:

- Limited in scope to creating a specific type of dapp.

- May not be challenging enough for more experienced developers.

Additional Resources of DApp examples

- State of the Dapps (https://www.stateofthedapps.com/): This website provides a comprehensive directory of decentralized applications built on various blockchain platforms, such as Ethereum, EOS, and Tron. The website features a user-friendly interface that makes it easy to browse through different dapps, and each dapp has a detailed description that includes information on its features, technology stack, and user ratings. I find this website useful for discovering new dapps and learning about their potential use cases.

- Dapp University (https://www.dappuniversity.com/): This YouTube channel is run by a software developer who creates and teaches others how to build decentralized applications. The channel features a variety of tutorials and guides on dapp development, covering topics such as smart contract programming, web3.js integration, and decentralized finance. I appreciate the clear and concise explanations provided in the videos, which make it easy to follow along even for beginners.

- DeFi Pulse (https://defipulse.com/): This website provides real-time data and analytics on various decentralized finance (DeFi) protocols, such as MakerDAO, Uniswap, and Compound. The website features a dashboard that displays key metrics, such as the total value locked in DeFi, the top DeFi protocols by usage, and the current Ethereum gas prices. I find this website useful for tracking the growth of the DeFi ecosystem and staying up-to-date on the latest trends and developments.

What exactly is Dapps?

DApps, or decentralized applications, are applications that run on a decentralized network, typically a blockchain. Unlike traditional applications that rely on centralized servers, DApps use the distributed computing power of a blockchain network to function. This means that they are not controlled by a single entity or organization, but rather by the community of users that participate in the network.

One of the key benefits of DApps is that they are inherently more secure and transparent than traditional applications. Since they are built on a blockchain, all transactions are recorded on an immutable ledger, making it nearly impossible for malicious actors to tamper with the data. Additionally, DApps are typically open-source, meaning that anyone can view and audit the code to ensure that it is free from bugs and vulnerabilities.

DApps have a wide range of potential use cases, from finance and gaming to healthcare and social media. By leveraging the unique features of blockchain technology, DApps have the potential to revolutionize the way we interact with technology and reshape entire industries.

Pros and Cons Of Dapps

DApps, or decentralized applications, offer several pros and cons that are worth considering.

Pros:

- Increased Security: DApps are more secure than traditional applications because they are built on a blockchain, which is inherently resistant to hacking and tampering.

- Transparency: Transactions on a blockchain are recorded on an immutable ledger, making it easy to verify the authenticity of the data.

- Decentralization: DApps are not controlled by a single entity or organization, but rather by the community of users that participate in the network, which ensures that the application is not subject to the whims of a centralized authority.

- Open-Source: Most DApps are open-source, meaning that anyone can view and audit the code to ensure that it is free from bugs and vulnerabilities.

- Efficient: DApps can be more efficient than traditional applications because they use distributed computing power, which reduces the burden on any single node.

Cons:

- Complexity: Developing a DApp can be complex, requiring specialized knowledge of blockchain technology and smart contract development.

- Scalability: DApps can be less scalable than traditional applications because they rely on the processing power of a distributed network, which can be slower than a centralized server.

- User Adoption: DApps can be difficult for the average user to adopt because they require the use of a dapp wallet and the understanding of blockchain technology.

- Regulatory Uncertainty: The regulatory environment for DApps is still uncertain in many jurisdictions, which can make it difficult to develop and deploy them.

- High Energy Consumption: Mining and running DApps can consume a lot of energy, which can be a concern for those who are environmentally conscious.

Despite these challenges, the potential benefits of DApps are enormous, and they are poised to become a major force in the technology landscape in the coming years.

Importance of DApps in the current market

Decentralized applications, or DApps, are becoming increasingly important in the current market. One of the main reasons for this is the rise of blockchain technology, which provides the foundation for many DApps. Blockchain technology is a distributed ledger system that is resistant to tampering and hacking, making it a secure and trustworthy way to store and transfer data.

DApps are built on top of blockchain technology and offer several advantages over traditional centralized applications. They are more secure, transparent, and decentralized, which means that they are not subject to the whims of a single entity or organization. This makes them more resistant to censorship, corruption, and other forms of manipulation.

Another reason why DApps are becoming more important in the current market is that they offer a new way for developers to monetize their applications. In traditional app marketplaces, such as the Apple App Store or the Google Play Store, developers are subject to strict rules and fees that can eat into their profits. With DApps, developers can monetize their applications directly through the use of cryptocurrencies or tokens, which can be traded on open markets.

Overall, the importance of DApps in the current market cannot be overstated. They offer a new way to build and distribute applications that are more secure, transparent, and decentralized than traditional applications. As blockchain technology continues to evolve and mature, we can expect to see even more innovative DApps emerge in the years ahead.

Purpose of the article

The purpose of this article is to provide readers with 10 creative examples of DApps across different industries, including gaming, healthcare, finance, and more. Along with popular Ethereum DApp examples such as Gnosis and Crypto.com DeFi Swap, we’ll explore DApps like Ujo Music, SpankChain, and Akasha. By showcasing real-world examples of DApps, readers can gain a better understanding of the potential uses and benefits of this technology. Each example will be accompanied by an overview of its features, benefits, and limitations, providing readers with a comprehensive understanding of each DApp. By the end of the article, readers will have a better understanding of the potential of DApps and how they can be used in various industries. This article aims to be informative, engaging, and valuable to anyone interested in blockchain technology and its potential applications. Don’t forget to check out our list of other resources of DApps examples for more inspiration and ideas.

Conclusion

In conclusion, these 10 examples of dapp demonstrate the versatility of decentralized applications in various industries. From gaming to healthcare, DApps can be used to create unique and innovative solutions that address real-world problems.

For developers looking to create their own DApps, these examples provide valuable insights into the potential of decentralized technologies. By studying successful DApps, developers can learn about the best practices in designing, developing, and launching a decentralized application. It’s also essential to consider the needs of the target audience, provide a user-friendly interface, and ensure the security and transparency of the platform.

As the blockchain industry continues to evolve, we can expect to see more creative and disruptive DApps emerging across different industries. With the help of decentralized technologies, we can create a more open, transparent, and decentralized world.

An experienced leader in software engineering and technology, I’ve driven value for top-tier Fortune 100 and 500 clients as the former CTO of Big Drop Inc. Overseeing a global team, we secured 34 global awards for pioneering web design using our proprietary tech. As the Co-Founder of Motion Design School, I created an innovative platform for global artists. Now, I apply my expertise to the dynamic world of blockchain, leveraging years of experience to shape decentralized technology’s future.